Five Top Charts and Insights from Wednesday

Closelook At Key Market Trends and Highlights

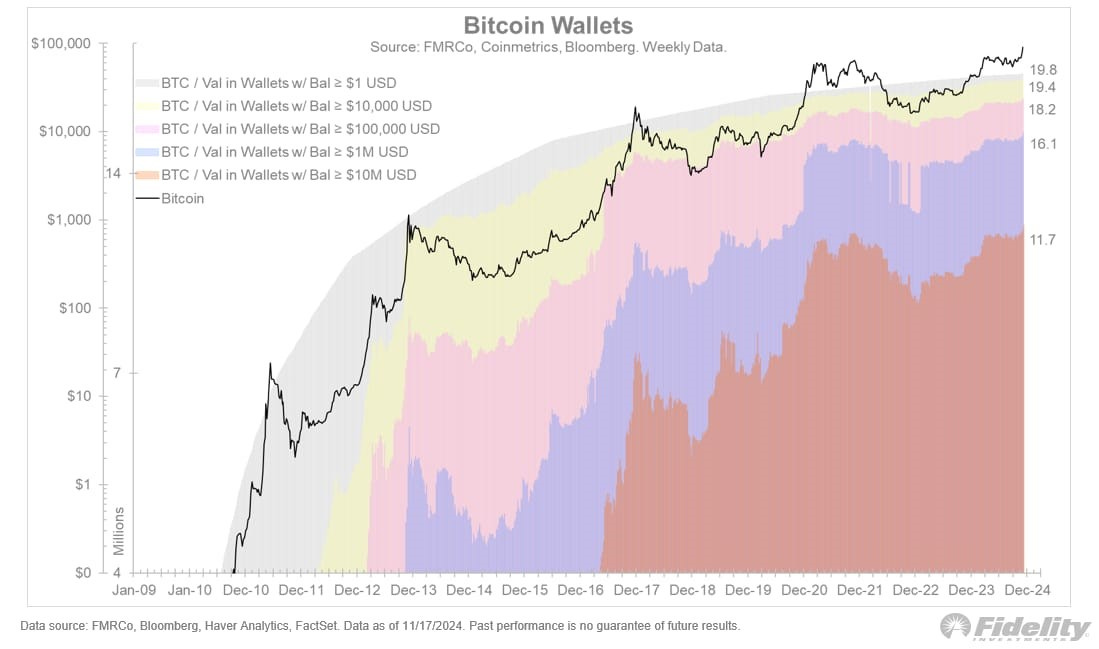

(1) OGs refuse to sell bitcoin

If they don’t sell when prices are low or when prices are high, when will they? Wallets holding $10 million or more account for over half of all wallets. Now that’s dedication!

"Below we see the distribution of [Bitcoin] wallets by the value they hold. It’s remarkable how committed the OGs have been, despite three harsh winters and massive profits ... (Jurien Timmer)

For more information, click here.

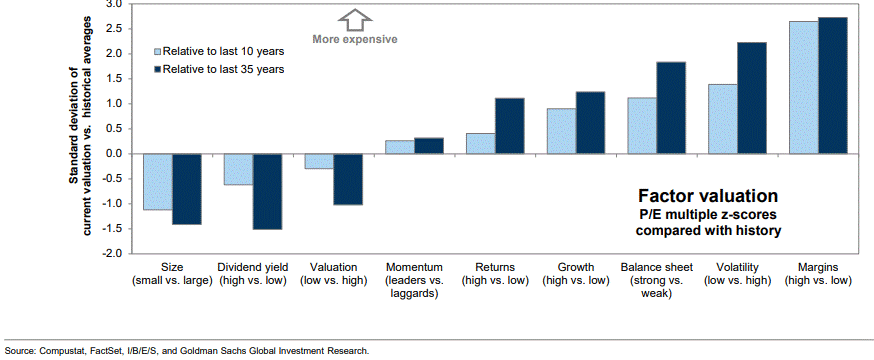

(2) A secular valuation trend or just a bubble

"Small caps and companies that pay a high dividend yield are currently 1.5 standard deviations cheaper than their average for the last 35 years. High-margin companies [are] some 2.5 standard deviations above the 35-year norm." (David Kostin)

For more information, click here:

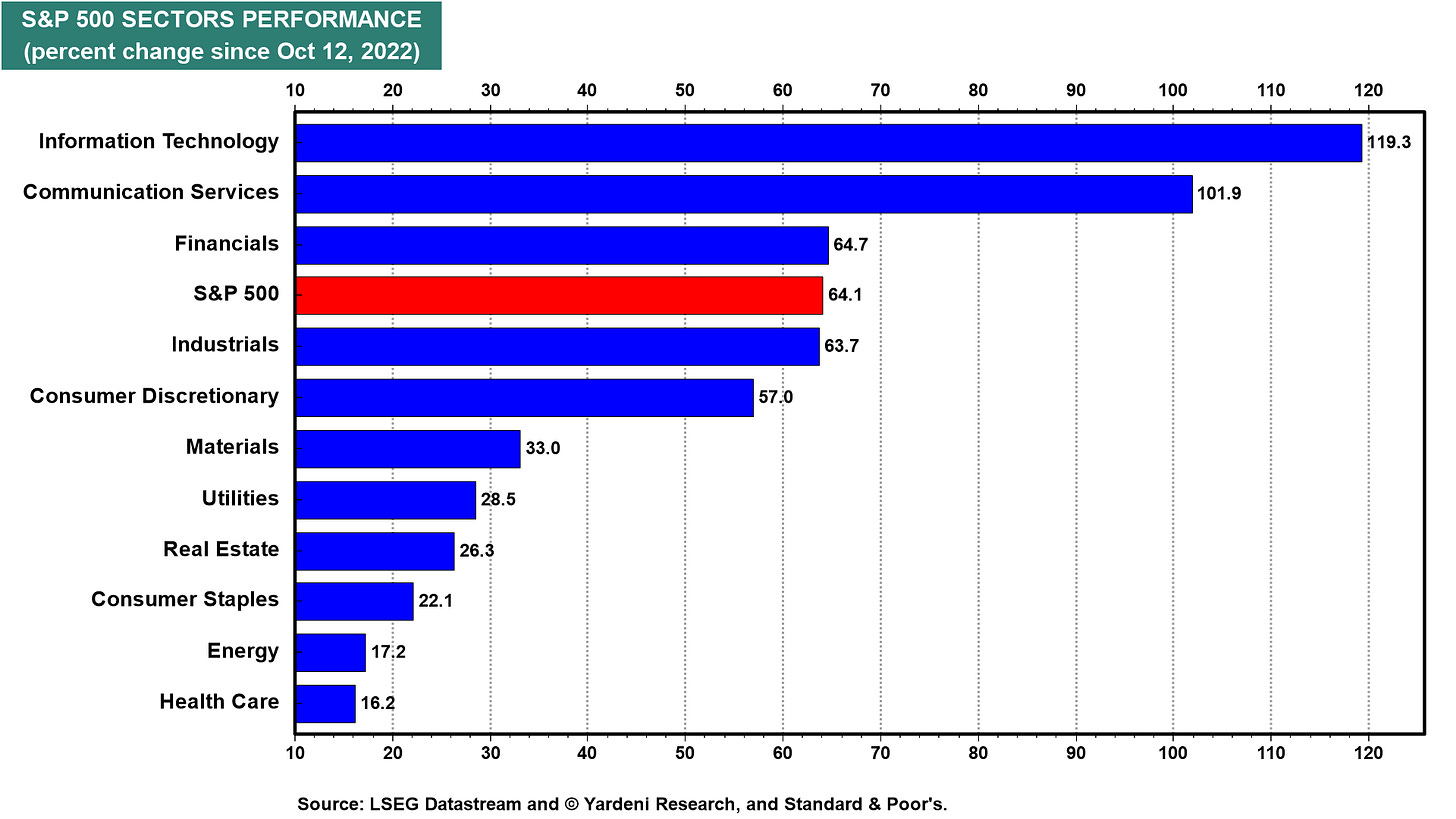

(3) SP 500 sector outperformance

Since the start of the bull market, the following cyclical sectors have outperformed the index: S&P 500 Information Technology, Communication Services, and Financials.

Ed Yardeni has recommended them along with Industrials and Energy. He is sticking with all of them except for energy.

He thinks they should all get a boost from stronger-than-expected economic growth over the next few months.

For more information, click here:

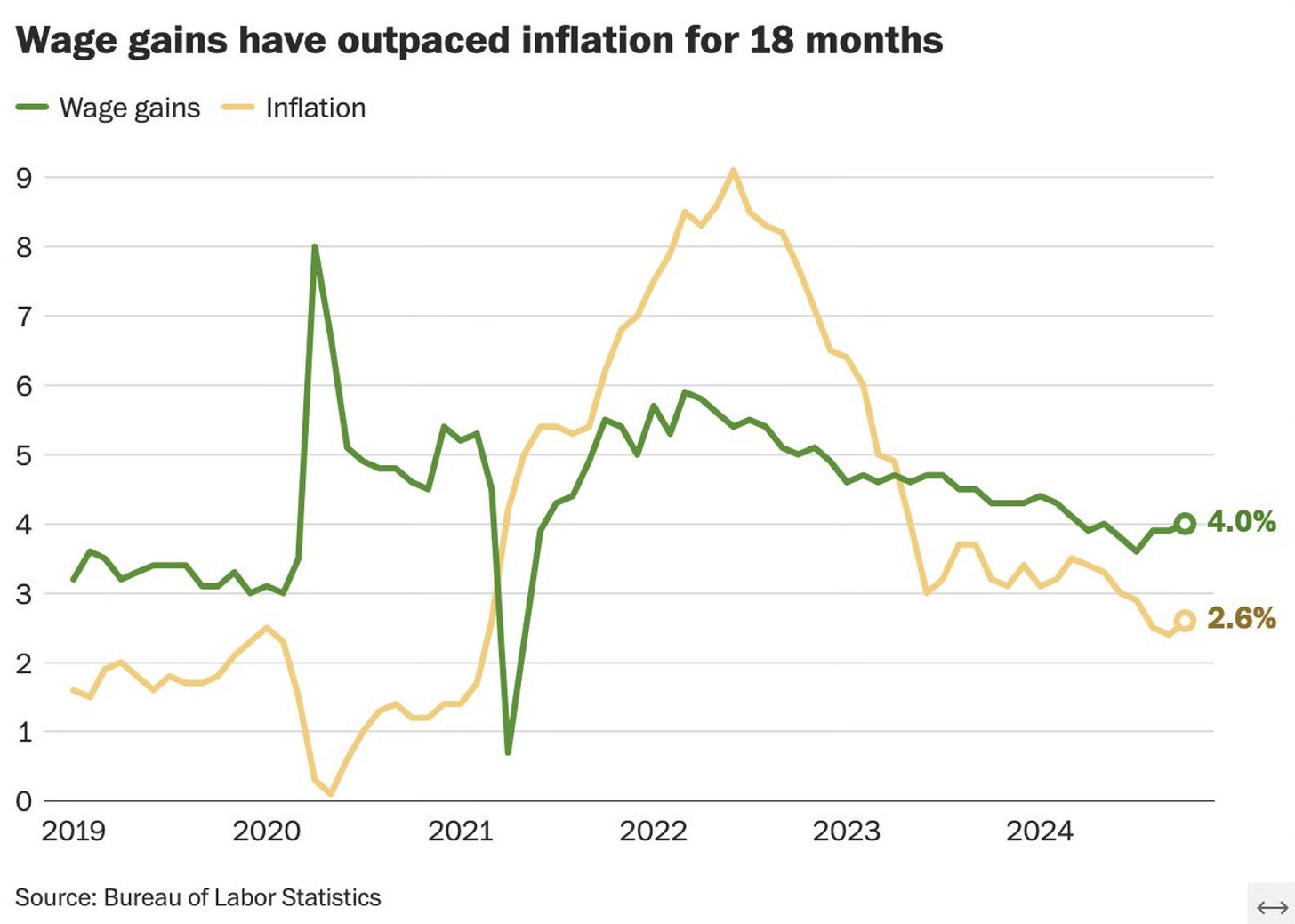

(4) Wage gains have outpaced inflation for 18 months now

For 18 months now, wage gains have outpaced gains in inflation.

In October 2024, wage gains were 4%, and inflation settled at 2.6%. For more information, click here:

Keep reading with a 7-day free trial

Subscribe to Closelooknet to keep reading this post and get 7 days of free access to the full post archives.