A New Dusk For Global Markets?

Global Stock Markets Retreat as Trump Rally Fades

Salve, cari subscripti!

Thank you for reading this week's edition of Closelook@Global Stock Markets, dated November 16, 2024 👋. The next edition will be published on November 16, 2024, at 2.00 p.m. ET.

The next edition of Closelook@US Stock Markets will be published on November 17, 2024, at 2.00 p.m. ET.

The next edition of Closelook@Hypergrowth will be published on November 20, 2024, at 2.00 p.m. ET.

A Closelook At This Edition

This Week's Action: Global Stocks In Retreat Mode

Global Stock Markets: Comprehensive Overview Of 36 Global Stock Markets

Trump Sectors: Hidden Winners, Obvious Losers And More

The ETF Portfolio: Continued Rebalancing

This Week's ETF Spotlight: ETFs For Hedging

Knowledge Corner: The German Stock Market

Upcoming Transactions: More Rebalancing Ahead

Final Words: Trump 2.0 vs Obama 3.0 (aka Biden 1.0)

(1) This Week's Action: Global Stocks In Retreat Mode

The week spanning from Monday, October 28 to Friday, November 01, 2024, displayed severe cracks in the global bull market narrative. The week spanning from Monday, 04 November until Friday, 08 November, displayed stock markets in bifurcation mode and seemed to have healed most of those cracks.

This assessment may have been wrong as the global stock markets resumed their path down in the week spanning from Monday, 11 November until Friday, 15 November.

The Dow Jones Global Index has been in a consolidation mode since the end of September 2024. The long-term bull channel is still intact.

The index lost about 1.6 percent on the week. It has been down 2 percent in the last 30 days. It is up 12,75 % YTD and 20 % in a 52-week perspective.

I expected a break above the trendline to occur this week if the US CPI and PPI showed that inflation was still moderating, kicking off the traditional year-end rally, which may last until the end of January (typical seasonal pattern).

The break-out failed when Chair Powell indicated that the Fed was in no hurry to lower rates and when the inflation figures in the US revealed continued stickiness in the core inflation and super core inflation subsectors.

While the odds still favor another rate cut in December, continued US rate cuts in 2025 seem more unlikely. This strengthened the US Dollar and at least temporarily ended the rally in gold.

Looking at the global stock markets, ex, the US, the situation worsens. The chart above shows the Vanguard FTSE All World Ex US ETF. The ETF failed to make an ATH in 2024.

It has declined much more than the Dow Jones Global Index, which is heavily skewed toward the US. However, the long-term bull channel is still intact.

(2) Global Stock Markets: Comprehensive Overview Of 36 Global Stock Markets

Argentina, Taiwan, Hungary, Taiwan, Germany (DAX), Spain, and India continue to be the seven best-performing global stock markets outside the US, taking a one-year perspective.

The table below displays 36 global stock markets. Laggards are Russia, Mexico, South Korea, and the German and Dutch midcap indices.

While the German DAX is among the top global performers, the MDAX is among the worst. DAX companies derive +70 percent of their revenue internationally. They are not an indication of the state of the German economy. MDAX companies do most of their business inside Germany/EU. They are an accurate indication of the state of the German economy.

Until last week, the Russian RTS Index was the only index in the red and the worst-performing one globally, taking a 1-year perspective. As of 15 November 2024, Mexico, South Korea, and the German MDAX have turned negative, too.

Taking a 5-day (the week after Trump's victory) view, only six of the 36 stock markets covered traded up for the week - Argentina, Norway, Hungary, Spain, Dutch AMX, and Austria.

Most of the biggest Asian stock markets performed miserably. Russia gave back part of the gains recorded in the week before.

The difference between the German DAX, MDAX, and SDAX is striking. The MDAX trades around 26,500, nearly 10,000 points below its 2021 peak. It is trading around the 2017/18 levels.

Using the DAX price index instead of the DAX performance index to compare the performance of the DAX with the major global stock markets, the stellar performance of the DAX companies becomes a bit more muted, too.

The index is 20 percent above the dot.com bubble peaks recorded over 20 years ago.

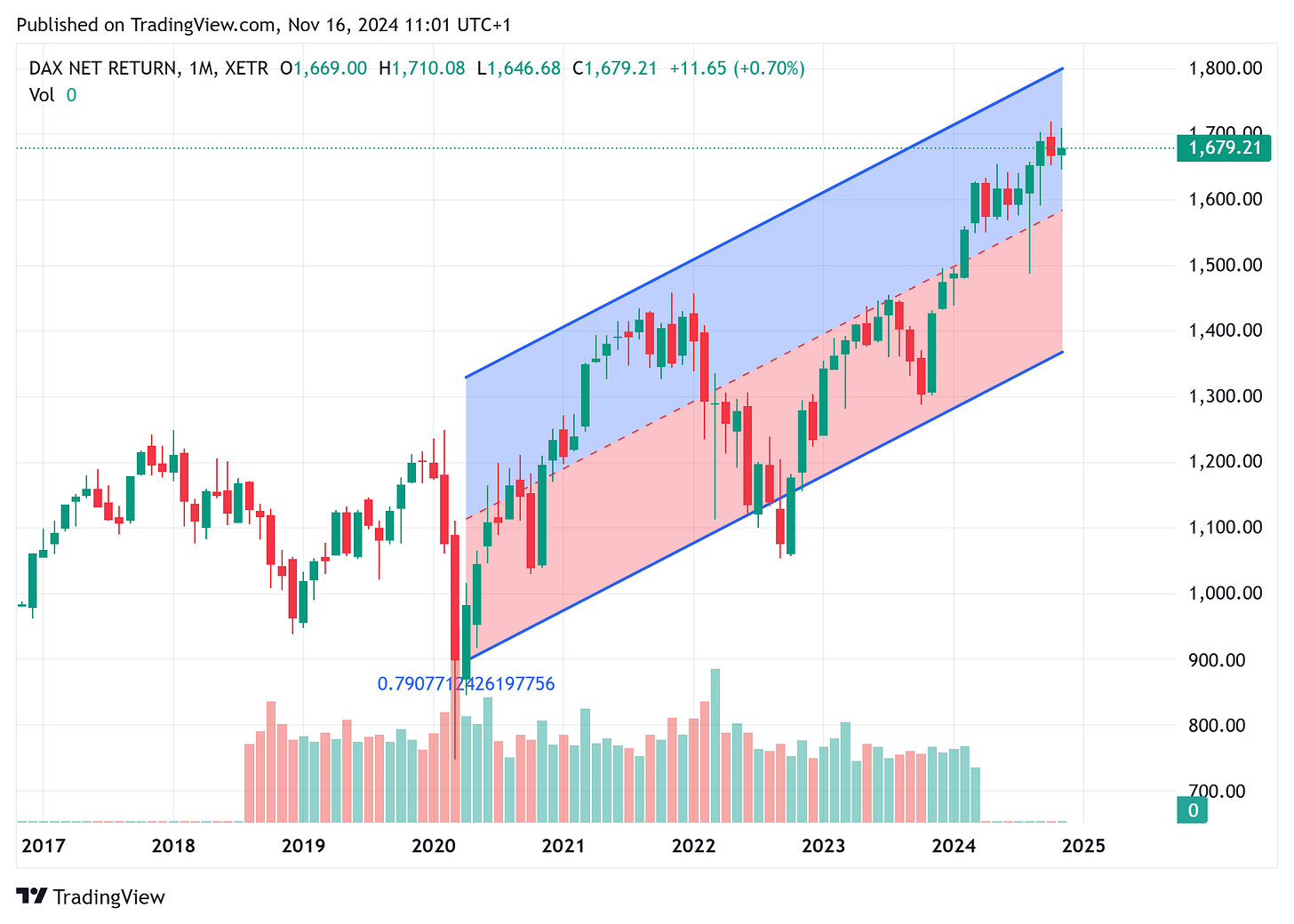

The DAX Performance Index is one of the best indices globally - the power of reinvesting dividends. Most major indices are price indices, however. So, using the DAX Performance Index for comparison leads to a distorted analysis.

The DAX Net Return Index deducts taxes from performance and is an accurate index for net returns.

The DAX Net Return Index, measured in USD, is best used internationally outside the Eurozone.

While the MDAX lags behind the DAX, the performance of the SDAX measuring small-cap stocks in Germany is even worse. At 5775 points, it is roughly 2,300 points below its 2021 peak.

The Russel 2000 has underperformed the SP 500 in the last few years, but compared with the SDAX, the Russel 2000 performance looks solid.

The dire state of the German economy can also be seen in the performance of the German TECDAX.

It was stellar from the bottom of the GFC until the Covid-19 peak. It has been a miserable performer since then. Trading at around 2,450, it is still more than 600 points below the Covid peak.

Times have changed, and the old German business model has stopped working. Charts and price action do not lie.

(3) Trump Sectors: Hidden Winners, Obvious Losers, And More

Based on this week's market reaction, the following market sectors may be net beneficiaries of the Trump election and have either sound or improving funnymentals and technicals.

(1) The Good

Crypto

Bitcoin

Altcoins

The related digital asset industries with stocks such as Coinbase, MicroStrategy, crypto miners, and ETFs such as the ones detailed in the table below.

MAHA (make America healthy again) Stocks

Clean food stocks such as Sprouts Farmers Market and similar

Personalized genetic testing and diagnostics stocks such as Natera

Dietary Supplement Industry (GNC Holdings or Vitamin Shoppe)

Fitness and Wellness Services (Planet Fitness, Peloton Interactive

Government Efficiency Stocks

Companies specializing in streamlining processes, reducing bureaucracy, and enhancing efficiency through technology could benefit. For example:

IT consulting firms like Accenture or Deloitte which help organizations optimize their operations.

Software companies such as Salesforce, ServiceNow, or Oracle which provide tools for workflow automation and efficiency

Tax Beneficiaries

The sectors that pay the highest taxes in the US as a percentage of their economic activity or net worth are:

Manufacturing

Manufacturing firms pay a significantly higher share of corporate income taxes relative to their net worth and receipts. According to the Urban Institute, manufacturing firms paid about 28% of total corporate income taxes after credits despite accounting for only 15.1% of net worth and 29.4% of business receipts.

Wholesale and Retail Trade

Wholesale and retail trade companies also pay a high share of taxes. They accounted for about 15.7% of corporate income taxes after credits, which is higher than their share of net worth (4.8%) but relatively in line with their share of business receipts (30.2%)

Finance and Insurance

While finance and insurance companies have a large share of net worth (57.3%), they pay a relatively lower share of taxes (19.4%) compared to their economic size. However, this sector still contributes significantly to corporate tax revenue.

Key Statistics

Manufacturing: 28.0% of corporate taxes, 15.1% of net worth, 29.4% of business receipts

Wholesale and Retail Trade: 15.7% of corporate taxes, 4.8% of net worth, 30.2% of business receipts

Finance and Insurance: 19.4% of corporate taxes, 57.3% of net worth, 8.5% of business receipts

Cyclical US Industrial Reflation Stocks

Under a second Trump administration, several sectors and stocks could benefit from the proposed policy changes, particularly those related to cyclical US industrial reflation.

Energy and Natural Resources

Trump's policies favoring domestic energy production, such as rolling back environmental regulations and expanding drilling in the Gulf of Mexico and Alaska, would benefit energy companies.

Oilfield services companies: Haliburton, Schlumberger, and other oilfield services providers would likely see increased activity and profits.

Natural gas companies: Companies like EQT and CNX Resources could benefit from expanded drilling and pipeline projects

Manufacturing and Industrial Sector

The proposed reduction in corporate tax rates to 15% for companies producing goods domestically, along with enhanced tax credits and subsidies, would incentivize manufacturing growth.

Automotive manufacturers: Companies like General Motors, Ford, and Stellantis could benefit from reduced taxes and potential tariffs on imported vehicles, although they might face challenges from tariffs on components sourced from Mexico

Industrial equipment manufacturers: Companies such as Caterpillar and Deere & Company could see increased demand and profitability due to lower taxes and deregulation

Financial Sector

Banks and financial institutions are expected to benefit from Trump's policies, including higher interest rates and deregulation.

Bank stocks: Companies like JPMorgan Chase, Bank of America, and Wells Fargo could see improved performance due to higher interest rates and reduced regulatory burdens

Defense and Aerospace

Trump's support for increased defense spending and a more robust military would benefit defense contractors.

Companies like Lockheed Martin, Boeing, and Northrop Grumman could see increased contracts and profitability.

Infrastructure and Construction

The anticipated boost in domestic manufacturing and infrastructure projects could benefit construction and related services companies.

Companies like Fluor Corporation, Jacobs Engineering Group, and Martin Marietta Materials could see increased activity and profits from infrastructure projects.

Cyclical Stocks

Cyclical stocks, heavily influenced by economic cycles, will likely benefit from Trump's pro-business and pro-growth policies.

Steel producers: Companies like Nucor and US Steel could benefit from tariffs on imported steel and increased domestic demand

Chemical and materials companies: Companies like Dow Inc. and DuPont could see increased demand and profitability due to lower taxes and deregulation

Key Stocks to Watch

Haliburton (HAL)

Schlumberger (SLB)

EQT Corporation (EQT)

CNX Resources (CNX)

General Motors (GM)

Ford Motor Company (F)

Caterpillar Inc. (CAT)

Deere & Company (DE)

JPMorgan Chase & Co. (JPM)

Bank of America Corp. (BAC)

Wells Fargo & Company (WFC)

Lockheed Martin Corp. (LMT)

Boeing Co. (BA)

Northrop Grumman Corp. (NOC)

Fluor Corp. (FLR)

Jacobs Engineering Group Inc. (J)

Martin Marietta Materials Inc. (MLM)

Nucor Corp. (NUE)

United States Steel Corp. (X)

Dow Inc. (DOW)

DuPont de Nemours Inc. (DD)

These companies and sectors will likely benefit from the combination of lower corporate tax rates, deregulation, and protectionist trade policies that Trump has proposed.

(2) Not Sure, Maybe, Neutral, Let’s See

Small Cap US Stocks in General: Only if interest rates do not rise too much

Taiwan Stocks: The markets anticipate that Taiwan may benefit from the Chinese stimuli. The AI-related and semiconductor-based bull market is in full swing and will continue in 2025 and 2026.

Russian Stocks: The markets seem to anticipate a Ukraine-Russia deal brokered by the Trump administration, but who knows?

(3) The Bad

European stocks: Trump does not care about Europe. Tariffs will hurt the European exporters, and the Eurozone faces structural problems. Germany is a nightmare on its own. Europe lacks an attractive tech sector in which to invest.

Rate-sensitive emerging markets: If bond vigilantes start to threaten the US credit markets and long-term rates go up beyond 4.5 % (and move close to 5 %), this will hurt some emerging countries with debt tied to the US Dollar and US interest rates.

Alternative energy (solar, wind, etc.): The losers from the drill baby drill approach

Chinese exporters and internationally oriented companies, incl. some Internet: Unless there is a deal (brokered by Elon Musk?), I see these companies as big losers.

(4) The Ugly

Japan

Japan is the only developed market economy with rising interest rates and a monetary policy that is becoming more restrictive. This usually does not bode well for equities.

The stock market may have completed nine waves up and may be in a more significant corrective phase.

United Kingdom

The UK stock market looks toppy to me. It is another European crisis economy.

Last week, the market broke below a vital support line.

I do not see a lot of attractive stock market sectors in the UK.

(4) The ETF Portfolio: Continued Rebalancing

From now on, I will detail the performance of the four investor portfolios in a weekly post in the Daily Brief section of the newsletter.

This will soon entail real-time trading signals. The next update will be on Sunday, November 17.

The ETF portfolio lost value during the week, which is in line with the performance of the key regions to which it has been exposed.

The two Indian ETFs and the Roundhill Weight Loss ETF are the biggest losers. The Bitcoin ETF has been the best performer.

I sold the Gold Miners ETF and replaced the “hedge position” with a Solana ETP.

(5) This Week's ETF Spotlight: German ETFs

ETFs to invest in different sectors of the German stock market entail:

(1) GX DAX Germany ETF (DAX)

The Global X DAX Germany ETF seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the DAX Index.

(2) Germany Ishares MSCI ETF (EWG)

The iShares MSCI Germany ETF seeks to track the investment results of an index composed of German equities. The ETF seeks investment results that correspond generally to the price and yield performance of the MSCI Germany Index.

(3) Germany Franklin FTSE ETF (FLGR)

The Franklin FTSE Germany ETF seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the FTSE Germany Capped Index. FTSE Germany Capped Index is a market-capitalization weighted index representing the performance of large and mid-capitalization German stocks.

(4) Germany Alphadex Fund FT (FGM)

The Fund's objective is to seek investment results that generally correspond to the price and yield of an equity index called the NASDAQ AlphaDEX Germany Index before the Fund's fees and expenses.

Keep reading with a 7-day free trial

Subscribe to Closelooknet to keep reading this post and get 7 days of free access to the full post archives.